Sona Nanotech Inc. Market Analysis Report Sept 2023

Initiating Market Analysis Report

Sona Nanotech Inc.

CNSX: SONA | OTCQB: SNANF

Sector/ Industry: Biotechnology

Author: Trevor Davis

Biocompatible Nanoparticle Technology Being Used to Develop Cancer Therapies & Rapid Diagnostics

- Sona Nanotech (Sona) explores the therapeutic application of its proprietary Gold Nanorod (GNR) technology for in-human use, thanks to its unique manufacturing technology that eliminates the toxicity of CTAB (a toxin used by other manufacturers).

- The acquisition of Siva Therapeutics has brought significant synergies in technology and human capital to Sona. Through this acquisition, the company has gained domain knowledge in Targeted HyperthermiaTM therapy, which currently serves as its main development focus.

- A recent Nanotechnology Characterization Laboratory (NCL) assessment of Sona’s GNR technology highlights the success of process improvement. The assessment demonstrates that the company’s continued enhancements in the manufacturing process for GNRs have led to a significant reduction in free surfactant levels in nanorod dispersions as well as better yields and particle size consistency.

- Recent updates on intellectual property (IP) reveal that the company has been granted IP for South Korea, and while the remaining territories are still pending, this has positive implications.

- The advancements in Targeted HyperthermiaTM (THT) development are expected to create additional commercial opportunities for the company, particularly in exploring the treatment of other types of cancer. However, secondary high-value development options are not included in this report.

- The out-licensing of prominent diagnostics applications from Sona’s development pipeline, such as bovine tuberculosis (bTb) and Traumatic Brain Injury (TBI) screening, is seen as an early opportunity for monetization.

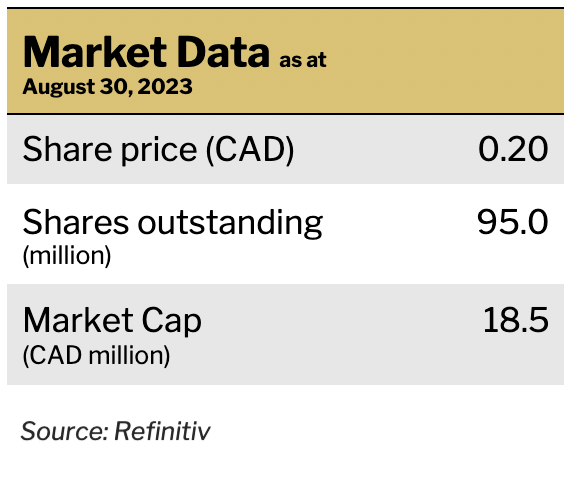

Opportunity Navigator

| Catalysts | Upside | Downside | Macro/Local risks |

| Light device completion for THT | The components for the light device are all pre-existing. A reputable healthcare engineering firm has been contracted to create the device. There is very little chance of the device being shown to be unsafe because it is simply infrared light being used internally. When the device is proven to be able to heat the nanorods in the tumor to the required heat internally, most of the heavy lifting in terms of efficacy would be done. | Developing the light device and advancing THT therapy may encounter unforeseen technical challenges and obstacles. If Sona faces significant difficulties or delays in developing the required technology or conducting preclinical and clinical studies, it could hinder the progress of the therapy. This could lead to delays in obtaining regulatory clearance, increased costs, and a prolonged timeline to commercialization. | The competitive market has other companies and technologies targeting cancer therapies and diagnostics. If competing companies develop similar or superior technologies for Targeted HyperthermiaTM therapy or diagnostics, it could pose a risk to market positioning and potential revenue. Strong competition may limit the company’s market share and impact its growth prospects. |

| Preliminary FDA meeting for THT | If the FDA provides positive feedback and guidance for the regulatory pathway of THT, it will indicate a smoother path for obtaining regulatory clearance for human trials. This would expedite the development process and potentially accelerate the commercialization of THT as a treatment for colorectal cancer with minimal invasiveness. | Unexpected regulatory challenges or difficulties in meeting the requirements set by regulatory authorities could lead to delays in the development and commercialization of THT. Stringent regulatory processes or unfavorable regulatory decisions could significantly impact the company’s growth prospects. | If healthcare professionals and patients are hesitant to adopt or recommend THT as a treatment option, it could slow down the market penetration and limit the commercial potential of the therapy. Market acceptance depends on factors such as efficacy, safety, cost- effectiveness, and reimbursement coverage. |

| Clinical trials | Every positive clinical trial result will cause the company to rerate and provide significant upside potential. It could provide Sona with a competitive advantage and shorten the timeline to generate revenue. | Safety issues may emerge during clinical trials, leading to adverse events or serious side effects. This is unlikely due to Sona’s GNR already being proven biocompatible. A lack of proven efficacy can lead to setbacks, necessitating additional research and development efforts. | Successful expansion of THT to other cancer types, such as head and neck cancer, esophageal cancer, prostate cancer, and bladder cancer, could significantly increase the market potential for their technology. This would open up additional revenue streams and position Sona as a leader in the field. |

| Licensing deals for lateral flow tests | The out-licensing of diagnostic applications, such as Bovine Tuberculosis and Traumatic Brain Injury screening, could provide early revenue opportunities. It would diversify the company’s revenue streams and support its financial growth. | Access to clinical samples is challenging. Finding the right licensing partner and crafting a deal that monetizes rapidly can take a long time. | Limited Market Demand: The market demand may not meet initial expectations. Changes in healthcare policies, shifting market dynamics, or evolving customer preferences can impact the demand for diagnostic tests. |

1. Company Overview

1.1 COMPANY BACKGROUND

Sona Nanotech (Sona) started in 2013 when Dr. Gerrard Marangoni, professor of chemistry at St Francis Xavier University, launched a research project into GNRs, intrigued as to why they weren’t being used more widely. He discovered that the presence of cytotoxins in the GNRs was a very important barrier to their adoption. The presence of the cytotoxic surfactant CTAB (cetyltrimethylammonium bromide) meant GNRs called into question the use in-vivo. For more than a decade, manufacturers of GNRs had been approaching the CTAB problem by coating, removing, or exchanging it and hoping for the best, but Dr. Marangoni’s solution was much simpler and involved making GNRs without CTAB.

Alongside his research associates, Dr. Kulbir Singh and Dr. Mike McAlduff, Dr. Marangoni set the goal to develop toxin-free GNRs that could be manufactured cost-effectively and at volume. After months of experimenting with different methods and chemicals, the team finally succeeded in developing GNRs free of CTAB. That’s when Sona was born – Sona being the Hindi word for gold. Sona’s inception was followed by years of hard work to perfect the process and develop the ability to synthesize large volumes of high-quality GNRs with patents filed in November 2017. In 2018, Sona merged with Stockport Exploration, listed on the CSE, and relocated to a new laboratory space at the Innovacorp Centre in Dartmouth, Nova Scotia. In February 2023, Sona announced the acquisition of Siva Therapeutics, a prominent company in developing Targeted HyperthermiaTM therapy (THT) for cancer treatment, colorectal cancer being the first clinical target. Combined synergies will allow Sona to actively pursue the use of GNRs both in therapeutic and diagnostics applications that have significant commercial potential.

1.2. GOLD NANORODS

Nanomaterials are the foundations of nanoscience and nanotechnology. The development of nanomaterials has attracted great interest worldwide in the past few years. The turning point for nanomaterials research was the discovery of carbon nanotubes in 1991. Nanomaterials are usually defined as having a particle size between 1 and 100 nanometers (nm). They are bigger than individual atoms (measured in angstroms, 1 Ã = 10-10 m). After this discovery, there was an explosive increase in the number of research teams working in the field. At nano dimensions, quantum effects, like quantum confinement, permit multiple applications. Some of the nanotechnology applications include alternative energy, electronics, catalysis, biomedicine, batteries, water treatment, and materials reinforcement.

In biomedicine, nanotechnology scientists have acquired the practical ability to create nanoscale particles that have proved to be a breakthrough in the fight against human diseases. Owning to their extraordinary capacity to capture and scatter light, these nanostructures, such as nanospheres, nanorods, nanoshells, nanostars, and nanocages, are of tremendous importance in bio-imaging and disease therapy. The difference in properties for different shapes of nanomaterials is based on two factors: the quantization of electronic states and a high surface-to-volume ratio.

Nanorods are defined as structures in the nanoscale whose length is two to twenty times longer than their width. There are several reasons why nanorods are relatively superior to spherical particles for certain applications. Relative to most other types of nanostructures, gold nanorods (GNRs) have greater extinction coefficients and narrower line widths, with higher photothermal conversion efficiencies and better sensitivity to local dielectric constant shifts.

These properties have given rise to various exciting possibilities to use GNR for Near-Infrared Resonant (NIR) biomedical imaging methods such as Two-photon lithography (TPL), Photographic Activity Test (PAT), Optical Coherence Tomography (OCT), and X-ray computed tomography (X-ray CT), and for hyperthermic therapy and gene/drug delivery. GNR is a platform that allows for mutual understanding of both diagnosis and clinical care in a single program with various diagnostic and therapeutic modalities. The other applications of GNRs opens the possibilities for selling them to a wider range of clients in future.

Consequently, GNR has proved promising in various biomedical applications, such as imaging, hyperthermic therapy, and drug delivery, due to their flexible surface plasmon and photothermal effects. These applications can be managed remotely by Near Infrared (NIR) light, penetrating deep into human tissue with limited lateral invasion. GNR, therefore, can integrate diagnostics and clinical treatment into a single framework and act as a NIR light-mediated network.

With Sona, the difference is in manufacturing. What differentiates Sona’s product portfolio is not the use of GNRs, but the manufacturing process they use. Sona’s manufacturing method (first patent issued) can avoid the need for CTAB altogether, producing stable and non-toxic GNRs. Sona has two product lines of GNRs, Omni and Gemini. For the Omni line, this means that the nanorods are non-cytotoxic and can be safely used in-vivo. For Gemini, it’s about flow. Nanorods produced with CTAB have difficulty flowing through the membranes used for lateral flow assays (LFAs). While there have been other attempts to remove CTAB, these are largely ineffective, leading to inefficient flow. The same problems come up with coated nanorods. With Sona’s proprietary manufacturing method, CTAB is avoided entirely and the nanorods can efficiently flow through the device.

1.3. SIVA THERAPEUTICS ACQUISITION

Sona made an announcement on March 23, 2023 regarding the completion of its acquisition of Siva Therapeutics, Inc. As part of the acquisition, Sona issued 15,107,457 common shares to the shareholders of Siva at a price of CAD0.1824 per share, based on the ten-day volume weighted average price, resulting in a total value of USD2.0 million. In addition, Sona may issue Performance Shares in up to four installments, totaling up to an additional USD6.65 million in Sona common shares, as consideration to the shareholders of Siva upon the achievement of certain milestones.

Siva Therapeutics was focused on the development of Targeted HyperthermiaTM cancer therapy (THT), which involved the use of GNRs and an infrared light device to generate therapeutic heat within solid tumors. Hyperthermia had several advantages over traditional treatments, such as being more selective than chemotherapy, less damaging than radiation, and free from surgical risks. THT’s initial clinical target was the first-line treatment for early to mid-stage rectal cancer.

While the survival rate for rectal cancer is relatively good (~65%) over five years, patients experienced a poor quality of life, indicating a significant unmet need. Rectal cancer is typically detected early through effective diagnostic methods, and its localized nature in early Stage 3 makes it suitable for interventional treatment. Targeted HyperthermiaTM offers a minimally invasive outpatient procedure that addressed this underserved patient segment.

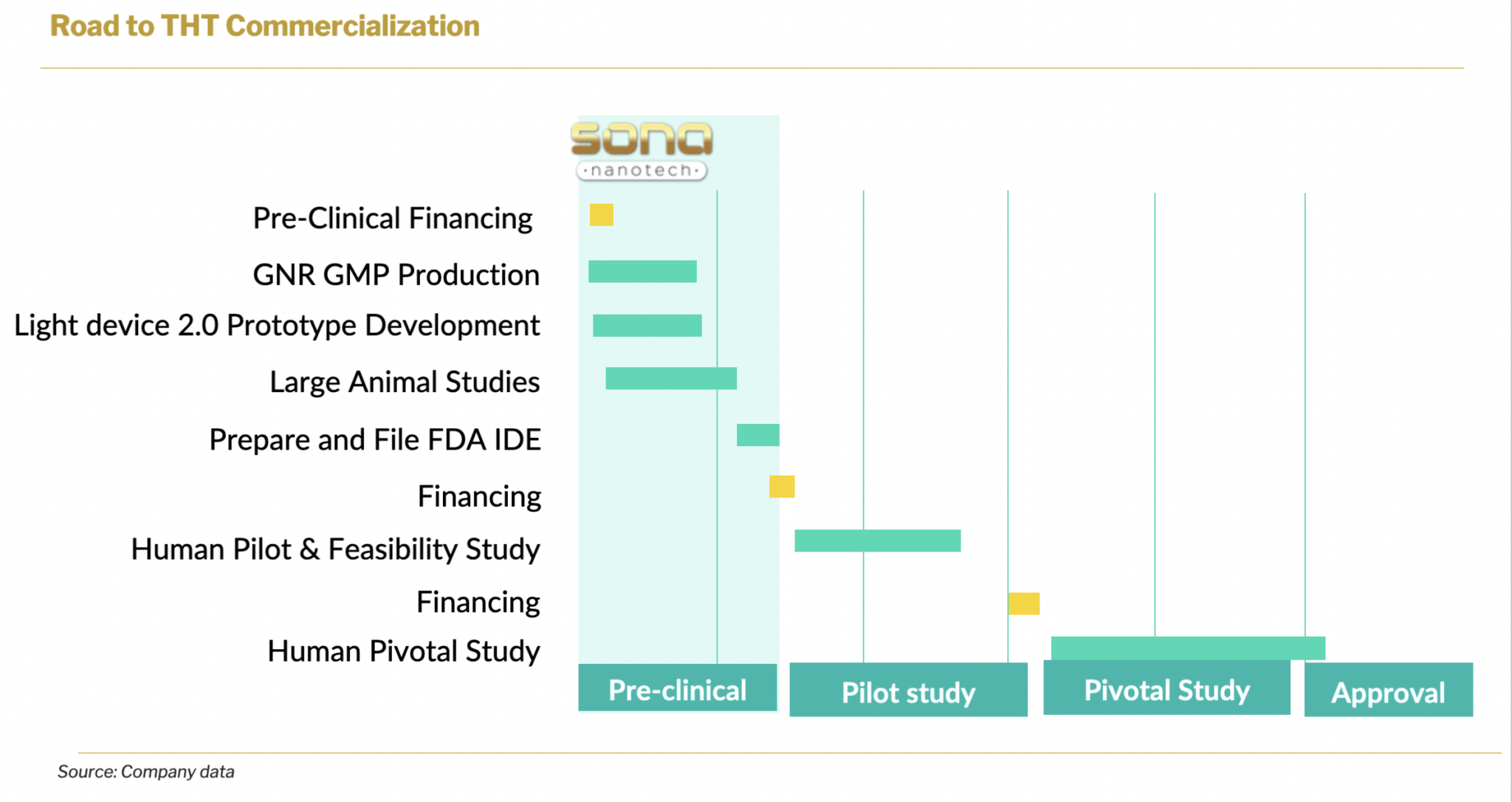

Prior to the acquisition, Sona had been supplying Siva Therapeutics with its GNRs for development purposes. Both companies recognized the synergies between their technologies and development paths, leading to a successful merger. Siva had raised over USD2.8 million in funding, including grants, angel investments (around USD0.8 million), and contributions from founders. Before the acquisition, Siva was preparing for large animal studies and seeking an Investigational Device Exemption (IDE) from the FDA in order to proceed with clinical studies. These activities would now be integrated into Sona’s development program.

Moving forward, Sona’s focus will be on advancing the development of THT photothermal therapy for cancer, utilizing Sona’s biocompatible GNRs. This will involve engaging regulatory counsel, obtaining laboratory accreditation for the production of the nanorods, enhancing light sources, and conducting further pre-clinical studies to obtain regulatory clearance for human trials. Following the successful development of THT treatment for colorectal cancer, Sona plans to expand its application to other cancers, including head and neck cancer, esophageal cancer, prostate cancer, and bladder cancer, all of which exhibit characteristics suitable for THT therapy.

Siva was admitted to the Nanotechnology Characterization Laboratory (NCL) program in 2016. The NCL, a US National Laboratory, offers grants of service to early-stage new cancer treatments involving nanotechnology that undergo a rigorous and comprehensive vetting process. Funded by the US National Cancer Institute and the FDA, the NCL program is internationally recognized and highly competitive. Siva successfully completed the entire NCL program, achieving outstanding results for nanorod manufacturing and safety. Additionally, Sona’s GNRs have also undergone the NCL program with exceptional outcomes. Given the NCL’s esteemed reputation and its affiliations with the FDA, participation in this program serves as a valuable de-risking step for any nano-cancer treatment advancing toward clinical application.

2. Products and Indications

Sona has built a technology pipeline that includes both commercialized GNRs and future development applications. The company currently distributes a line of commercially available CTAB-free GNRs under the brand name Gemini and also develops a pipeline of therapeutic and diagnostics applications that are targeted towards the treatment of colorectal cancer (by Targeted Hyperthermia TM) and diagnostics of bovine tuberculosis and traumatic brain injuries (TBI).

2.1 TARGETED HYPERTHERMIA THERAPY ™ (THT)

MARKET

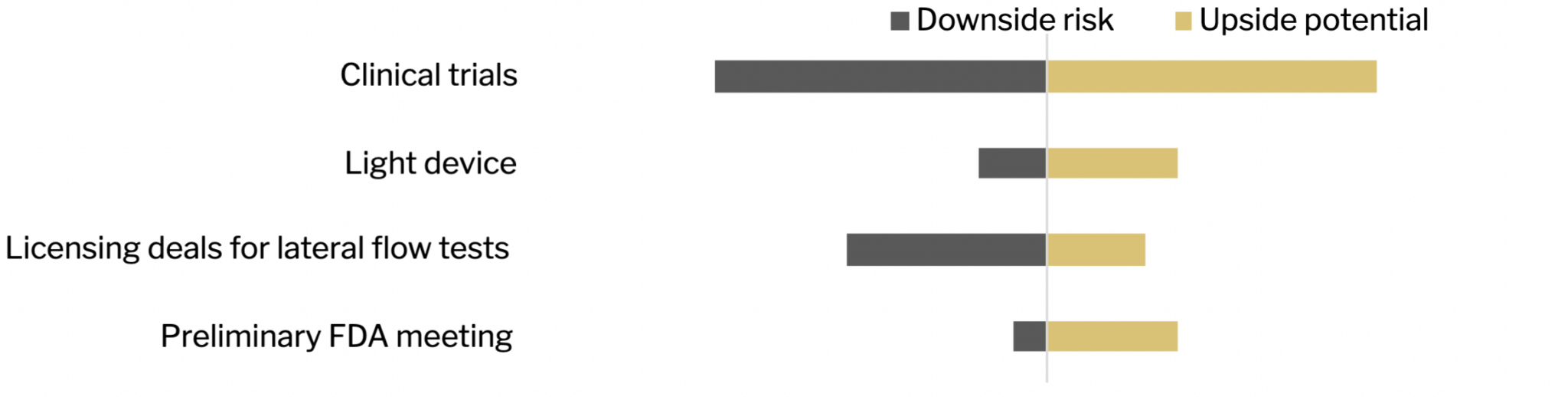

Colorectal cancer, resulting from genetic and/or environmental factors, is a highly prevalent and deadly form of cancer. According to the World Health Organization (WHO), it ranks as the third most common cancer worldwide, with approximately 1.93 million cases reported globally in 2020. By 2030, experts anticipate a staggering 70% increase in colorectal cancer cases worldwide. The National Institute of Health states that colorectal cancer accounts for over 9% of all cancer incidences and remains a major cause of morbidity and mortality globally. In 2020 alone, colorectal cancer claimed the lives of around 916,000 individuals. It is the third most frequent cancer among men and the second most common among women. The risk of developing colorectal cancer during one’s lifetime is approximately 1 in 23 for men and 1 in 25 for women. Consequently, colorectal cancer stands as the third most prevalent cancer and the second leading cause of cancer-related deaths.

Colorectal cancer arises from uncontrolled cell growth in the colon or rectum. Since colon cancer and rectal cancer share similar characteristics, they are often grouped together. The disease typically begins as abnormal growths called polyps in the inner lining of the colon or rectum. Not all polyps develop into cancer, but they can serve as precursors.

Common symptoms of colorectal cancer include blood in the stool, weight loss, fatigue, and irregular bowel movements. Diagnosis involves tests such as Cologuard, endoscopic examination, and biopsies to confirm the presence and extent of the cancer. Treatment options vary depending on the stage and progression of the disease, with most oncologists recommending a combination of radiation therapy, chemotherapy, and targeted therapy. Despite significant advancements in cancer research and technology, colorectal cancer continues to pose a threat to lives worldwide. As a result, the increasing number of patients seeking colorectal cancer solutions has driven the growth of the global colorectal cancer market. Unhealthy eating habits and irregular food consumption patterns among individuals contribute to the growing prevalence of colorectal cancer, further fueling market expansion.

Individuals with localized stage colorectal cancer have a 90% chance of surviving five years or more. The 5-year survival rate drops to 71% when cancer spreads to nearby tissues, organs, or regional lymph nodes. Unfortunately, only about 39% of patients are diagnosed at this early stage. Surgical intervention, radiation therapy, chemotherapy, immunotherapy, and targeted treatment are the primary treatment modalities for colon and rectal cancer, often used in combination based on the cancer stage.

Pharmaceutical products, such as chemotherapy drugs and targeted therapies like monoclonal antibodies, account for a significant portion of the market. Medical devices used in surgeries and imaging equipment for diagnosis and staging also contribute to the market size.

Geographically, the North American market holds the largest share of the global colorectal cancer market, followed by Asia-Pacific and Europe. In 2022, North America accounted for a market share of 37% and is predicted to maintain its lead throughout the forecast period. The United States, in particular, dominates the North American market due to increasing consumer awareness about colorectal cancer diagnosis and treatment. Government support for the development of colorectal cancer procedures and drugs has also spurred market growth in the region.

Asia reported 1,009,400 new cases of colorectal cancer in 2020, according to the International Agency for Research on Cancer & GLOBOCAN1. Japan, China, Malaysia, Singapore, Korea, and Turkey exhibited higher prevalence rates compared to other countries in the Asia-Pacific region. Rising disposable incomes, increasing colorectal cancer prevalence in critical countries such as China and India, growing awareness of the disease, its status as a leading cause of death, a large population base, improving healthcare infrastructure, and technological advancements in the industry are expected to create growth opportunities in the regional market. The colorectal cancer markets in Latin America, the Middle East, and Africa are anticipated to witness steady growth due to the increasing prevalence of colorectal cancer and rising awareness about the disease.

The current therapies for colorectal cancer include a combination of surgery, chemotherapy, targeted therapy, immunotherapy, and radiation therapy. The specific treatment approach depends on the stage of the cancer, the location of the tumor, and individual patient factors. Here are the main therapies used in the treatment of colorectal cancer:

- Surgery: Primary treatment for localized colorectal cancer. The extent of surgery depends on the stage and location of the cancer. Surgical procedures may include local excision (removal of small tumors or polyps through endoscopy), colectomy (partial or complete removal of the colon), proctectomy (removal of the rectum) or lymphadenectomy (removal of nearby lymph nodes for staging and to prevent the spread of cancer).

- Chemotherapy: Uses drugs to kill cancer cells or inhibit their growth. It can be used before surgery (neoadjuvant chemotherapy) to shrink tumors, after surgery (adjuvant chemotherapy) to kill remaining cancer cells, or in advanced stages of colorectal cancer

- Immunotherapy: Aims to stimulate the body’s immune system to recognize and attack cancer cells.

- Radiation Therapy: Uses high-energy X-rays or other radiation sources to kill cancer cells or shrink tumors. It may be used before surgery to shrink tumors, after surgery to destroy remaining cancer cells, or in palliative settings to relieve symptoms caused by advanced colorectal cancer.

- THT AS AN ADJUNCTIVE TO CURRENT TREATMENT

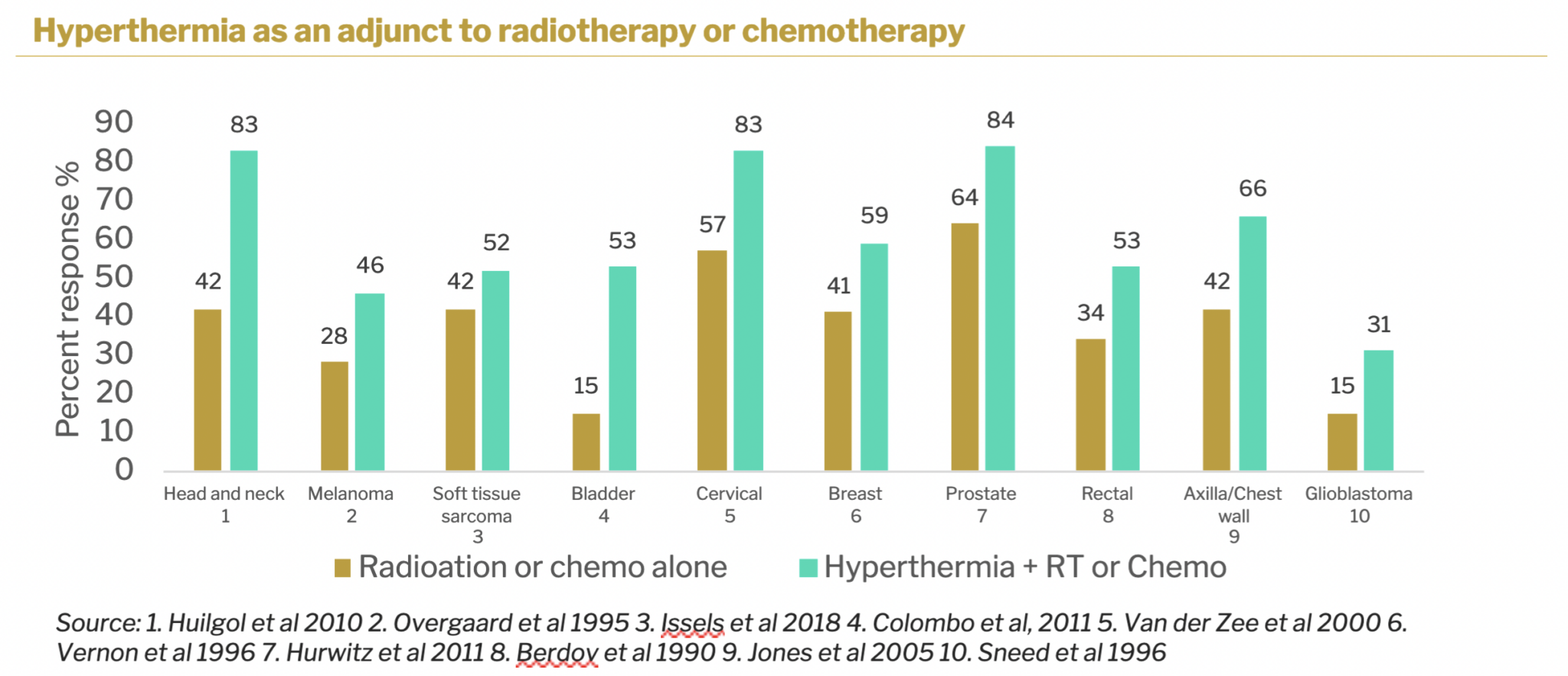

There is substantial published data on the adjunctive use of hyperthermic treatment with drug therapy and with radiation therapy for a variety of cancers. In virtually all cases, clinical outcomes are improved when hyperthermia is added to either drug or radiation therapy. One of the greatest improvements seen is for colorectal cancers. Hyperthermia could also be used as a neoadjuvant for surgery, shrinking tumors and making them more easily resectable. Sona’s Targeted Hyperthermia TM therapy differs from conventional hyperthermia in that it is a more specialized approach that uses gold nanorods, to deliver heat selectively to cancer cells. Many current photothermal therapies used today involve raising the temperature of the target area above hyperthermia’s ~44 degrees C where there can be significant collateral damage to healthy tissue.

SONA TARGETED HYPERTHERMIA THERAPY ™ (THT)

Sona’s initial clinical target is a continuation of its existing research in first-line treatment for early to mid-stage rectal cancer. Targeted HyperthermiaTM treatment for rectal cancer will be a minimally invasive outpatient procedure that addresses an underserved patient segment. THT is an interventional oncology approach that employs the systemic injection of Sona’s GNR into the patient and illumination of the affected region with a patented near-infrared light device. The GNRs concentrate on tumors, absorb the infrared light, and convert it into therapeutic heat which emanates from within the tumor mass. Heat stimulates the immune system, shrinks tumors, and enhances drug efficacy.

Sona’s THT studies have produced very strong preclinical efficacy data, both as a monotherapy and in combination with a leading cancer drug. Sona’s THT stand- alone treatment is significantly more effective than drug monotherapy: all animals on the drug alone were dead by 30 days after the study began. Combination treatment with both THT and drug yielded outstanding results: 66% of the animals survived and thrived out to 95 days post-treatment, the end of the study, with no evidence of residual cancer.

COMPARISON TO ABLATION

Interventional oncology uses a variety of targeted techniques to image and guide treatments as well as to perform treatment procedures such as ablation (using either hot or cold temperatures). Ablation, generally 55°C/131°F and above or – 196°C/-320°F (liquid nitrogen temperature) is very effective for destroying tissues and can effectively destroy cancer cells, but it does not distinguish between healthy and cancerous cells. On the other hand, THT, at a temperature of 44°C/111°F, has a unique ability to achieve and maintain a gentle hyperthermia in solid tumors. This sets THT apart from other treatments and makes it unique. Hyperthermia selectively induces biochemical changes in cancer cells, which are more heat- sensitive than healthy cells, and thus selectively targets tumors. Sona will be the first company to use hyperthermia in this way.

EXPANSION TO OTHER CANCERS

Colorectal cancer is not the only cancer type that can be targeted with THT therapy. The list below summarizes the applicability of THT to main cancer types. Head and neck and esophageal cancers are the next potential candidates for technology development, nevertheless for this report purpose analysis and calculations solely are based on colorectal cancer type.

A comprehensive ranking exercise was undertaken to determine the most suitable initial or beachhead market niche, and the ranking of the best target markets for THT yields this list:

Colorectal cancer

Head and neck cancer

Bladder cancer

Esophageal cancer

Prostate cancer

Glioblastoma

Lung cancer

Among various factors considered, such as unmet need, market size, integration into clinical workflow, and patient advocacy.

2.2 DIAGNOSTICS

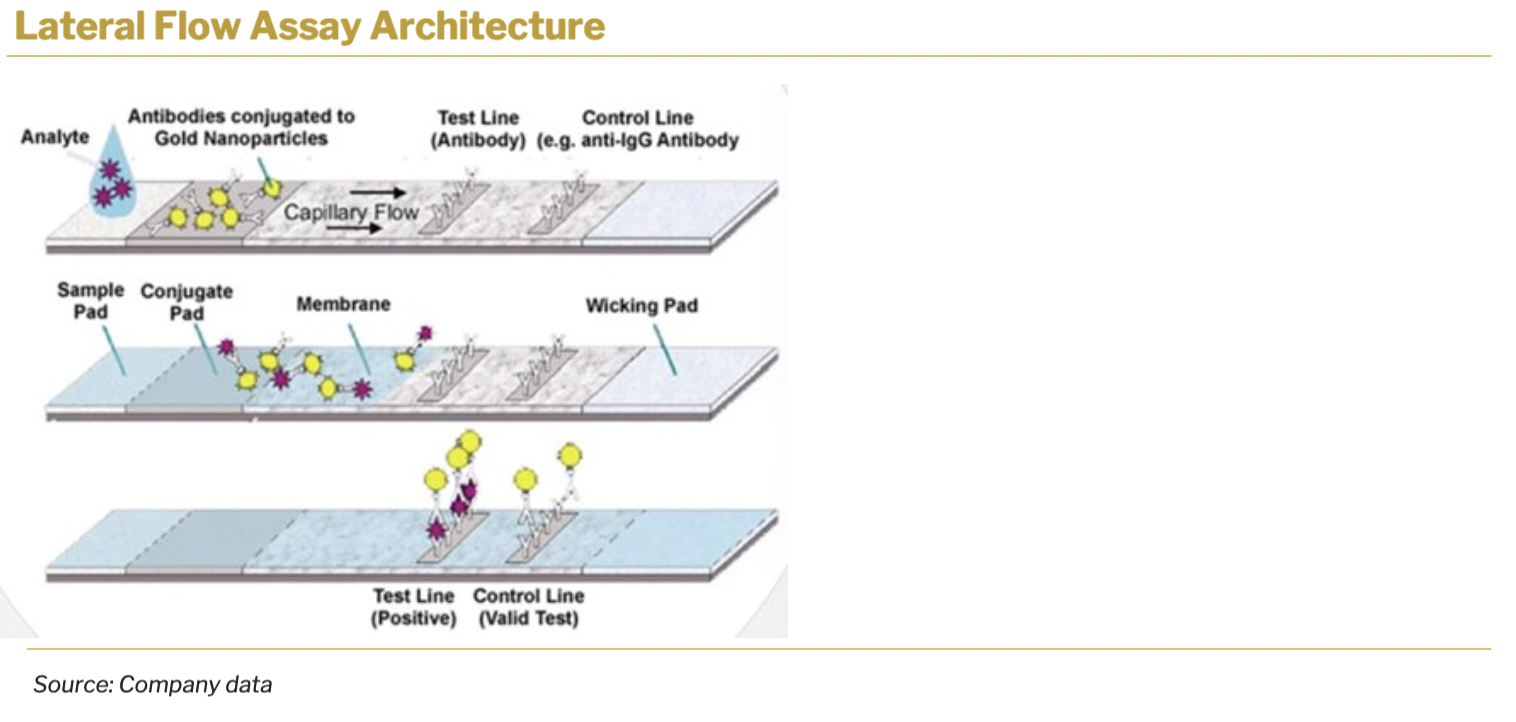

Rapid lateral flow tests have become indispensable tools for point-of-care diagnostics due to their simplicity, speed, and cost-effectiveness. These tests typically involve the transport of bodily fluids, such as saliva, urine, or blood, through a test strip containing a bio-chemical reaction indicator.

The advantage of Sona’s GNRs in diagnostics devices is that they enable increased sensitivity and specificity for lateral flow assays.

The core principle behind most lateral flow assay kits involves the staged transport of bodily fluids. When a sample is applied to the test strip, the fluid is wicked along the strip’s surface, gradually reaching the site of a bio-chemical reaction indicator.

As the fluid reaches the designated area, the analyte of interest is adsorbed and reacts with the bio-chemical indicator present on the strip. This reaction is crucial in generating a specific response that will be later detected and interpreted.

A key characteristic of lateral flow tests is the color change that occurs when the reaction between the analyte and the bio-chemical indicator takes place. This color change is observable and serves as the basis for reading the test’s results. A separate control strip on the test ensures accuracy and reliability.

Sona’s approach for its diagnostics division is to license out the technology to the development partner once it reaches the patentability point.

BOVINE TB DIAGNOSTICS

Sona’s bovine tuberculosis (bTB) test is a planned product in the company’s diagnostics pipeline. Sona’s bTB rapid test prototype is being developed with the financial and advisory support from the National Research Council of Canada (“NRC”) Industrial Research Assistance Program (“IRAP”) in association with a consortium of UK companies who benefit from financial support from Innovate UK (“IUK”).

Sona’s bovine tuberculosis solution will provide early detection of the disease at a low cost and most importantly without the need for test-and-slaughter, resulting in essential savings for business agents. Blood samples will be taken for a rapid lateral flow test, users will be able to track and monitor test results in the associated app. Most importantly, the Sona’s test will be configured as a rapid screening of individual animals, with no need to destroy healthy cattle. Tests will allow users to discern TB positive from TB-inoculated cattle.

Currently, no cost-effective early detection methods are available, as diagnosis through skin test takes 48-72 hours for result turnaround whereas post-mortem examination and tissue culture can take up to 12 weeks. The long lag between testing and result turnaround poses a significant risk of disease transfer between livestock, and once bTB is confirmed, all exposed animals in a herd are destined to be destroyed, posing a significant economic loss for farmers and economic agents. Estimated costs of bovine TB control in the UK to top £1 billion over the next decade. Another issue in current diagnostics is that skin tests can not distinguish between infected and vaccinated cattle, resulting in an inability to rightly identify infectious subjects. The following tests are currently available:

Tuberculin Skin Test (TST)

The TST is the primary test for bTB in cattle. It involves injecting purified protein derivative (PPD) into the skin and measuring the skin’s reaction after a certain period. This test is widely used but can produce false-positive or false-negative results.

Interferon-Gamma Release Assays (IGRAs)

IGRAs are blood tests that measure the release of interferon-gamma by white blood cells exposed to bTB antigens. They offer increased specificity compared to the TST.

Serological Tests

Serological tests detect antibodies against bTB in blood or milk samples. These tests can be useful for herd surveillance but are not suitable for individual animal diagnosis.

Molecular Tests

Polymerase Chain Reaction (PCR) and other molecular tests detect the DNA of Mycobacterium bovis, the causative agent of bTB. These tests offer high sensitivity and specificity and can be used for early detection and confirmation of bTB.

A bovine TB diagnostics device has been developed as a lateral flow assay. There are multiple advantages of using lateral flow assays (LFAs) as a diagnostic tool. They are fast and easy to use and significantly of low costs. Compared to the other methods they can provide results rapidly at the point-of-care and can be administered in remote locations.

TRAUMATIC BRAIN INJURY (TBI)/CONCUSSION

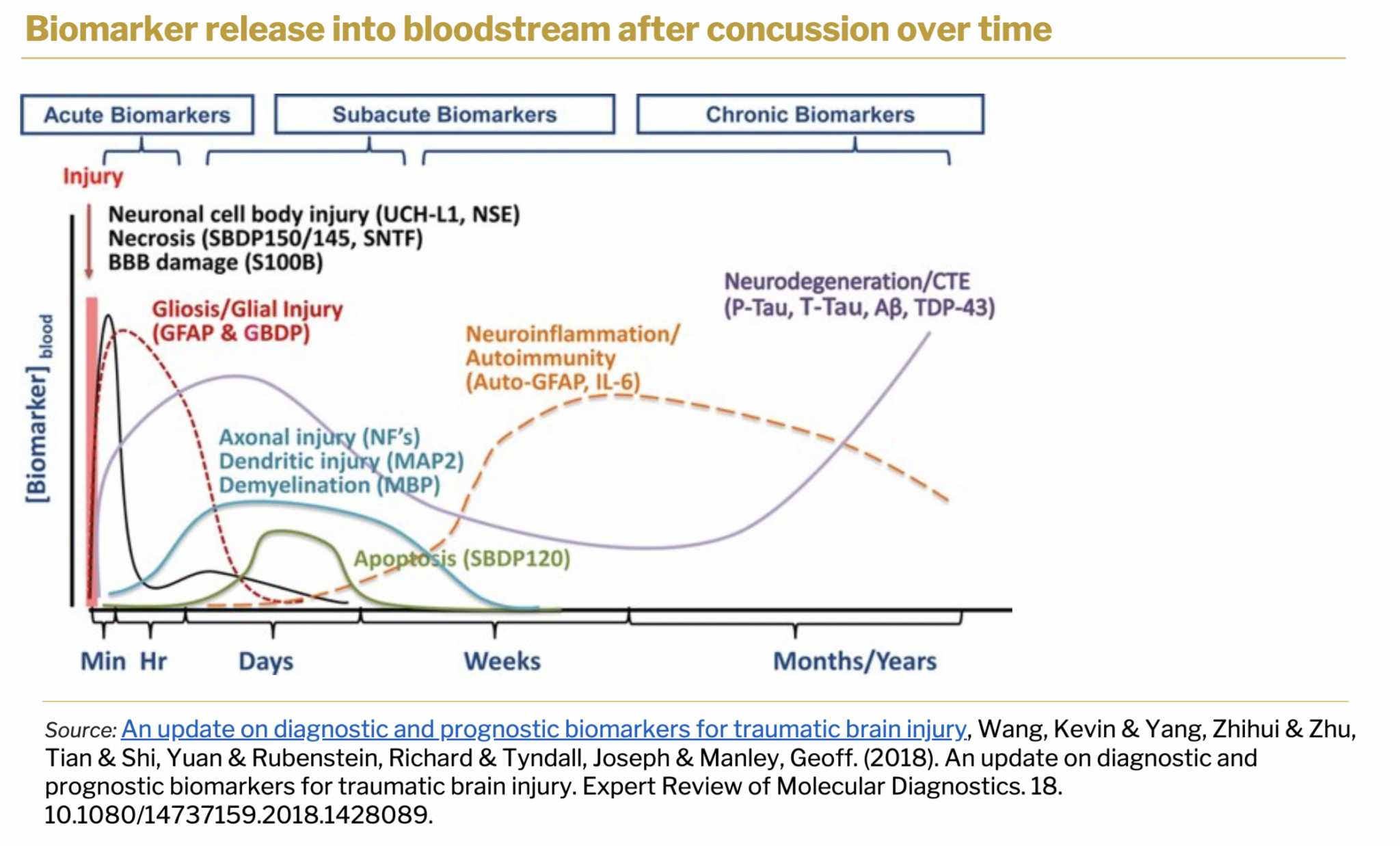

Current problems in concussion screening tests are multimodal. Tests rely on subjective cognitive assessment, and there are no tests available that would serve as readerless rapid concussion tests. Sona’s concussion screening solution has the potential to address the gap in market needs and existing solutions. Glial Fibrillary Acidic Protein (GFAP) is released into the bloodstream within minutes of a concussion and is a key biomarker used by Sona’s TBI assay.

GFAP is next to be multiplexed with other concussion biomarkers to create a unique molecular TBI fingerprint. Sona’s test will rely on definitive biomarker identification associated with concussions. Biomarkers have been validated in-lab with contrived concussion blood samples and as a next step company plans to validate results with clinical samples. Sona’s plan for this product development is to license out the technology to the development partner once it reaches the patentability point.

As in the case of bovine TB, traumatic brain injury diagnostics devices will be created in the form of lateral flow assays (LFAs). Similar to bovine TB, the same advantages of simplicity, ease-of-use, point-of-care application, and low cost of the device will differentiate Sona’s product from its peers.

According to Stanford Children’s Health, over 3.5 million sports-related injuries are reported annually among children in the US and around 21% of all are TBIs.

The main use of the Sona concussion lateral flow assay will be to provide information to coaches to assist in TBI screening and for eligibility for a player to go back into play or be directed to a physician.

3. Investment Case Overview

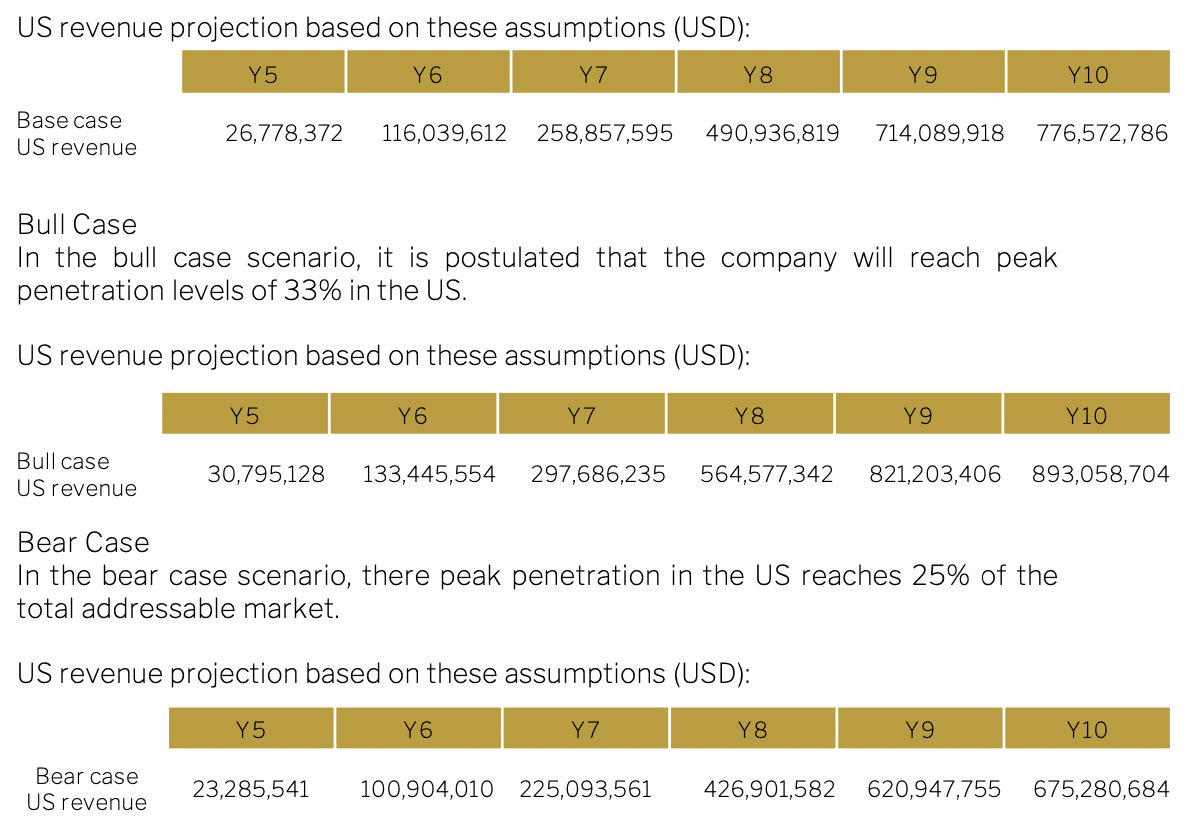

Following are the outcomes of bear, base, and bull case scenarios for revenue growth in THT, the flagship product for Sona. Key assumptions that are the basis of these calculations are peak penetration rates, cost structure, and probabilities of success. We show in every case the revenue projections for the US only, even though expansion to other markets is likely.

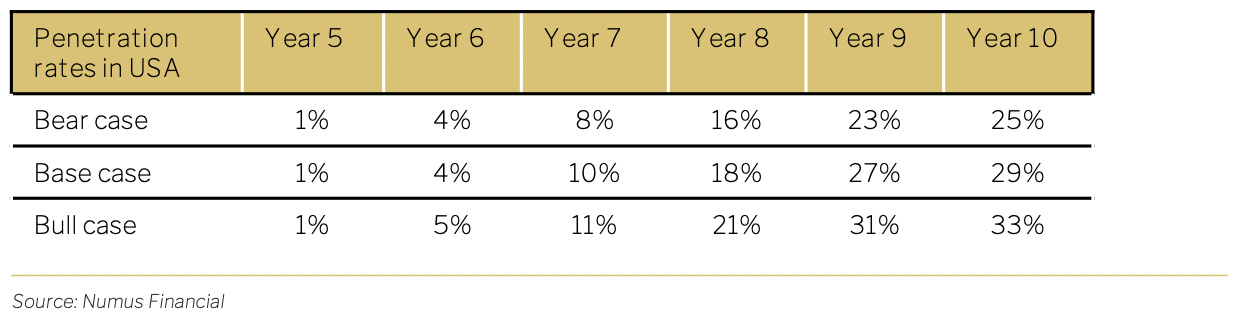

Penetration rates

Our model of market penetration is based on the historical pattern of new therapeutic drug adoption. For the US revenue projections, we have assumed 1% initial penetration in all scenarios, scaling to peak penetration in Year 10 of 25% in the bear case, 29% in the base case and 33% in the bull case.

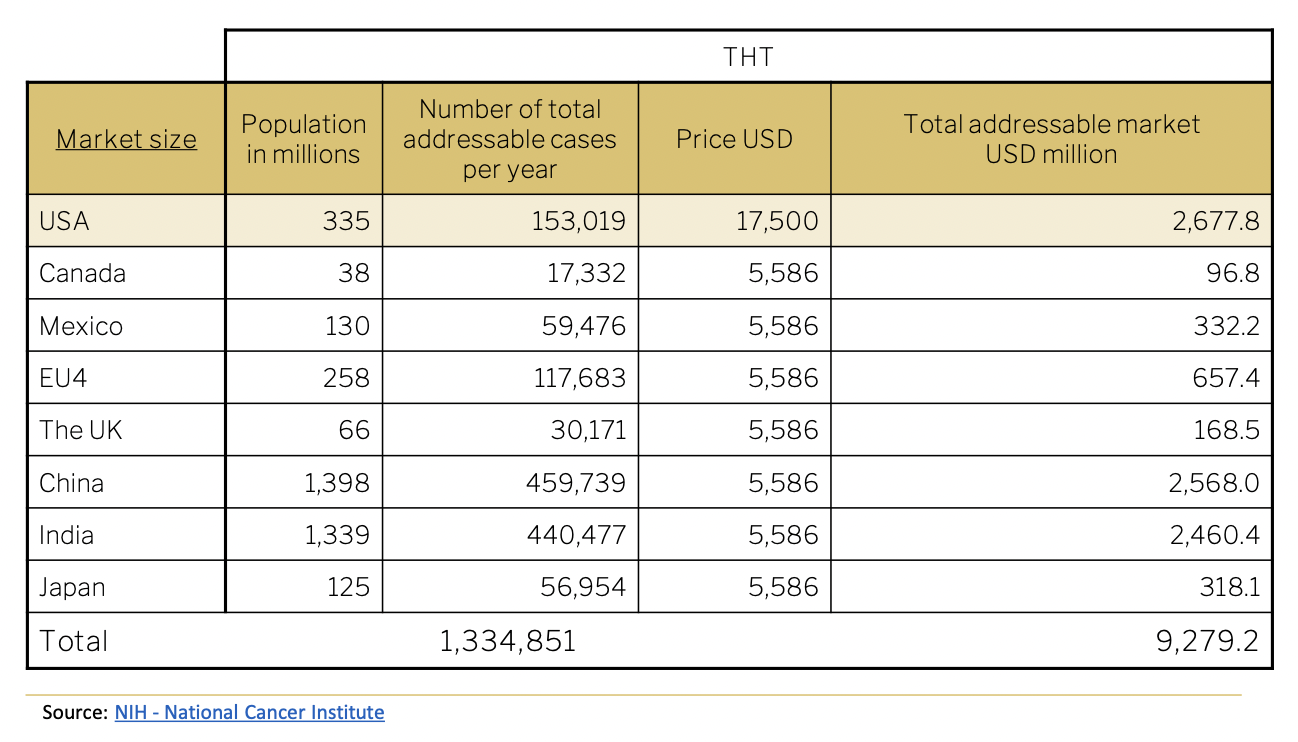

Using the total population, and incidence rate of 0.05%, propensity to seek treatment of 50% and 2 treatments per year, the total addressable market is calculated below. Treatments are priced at USD 17,500.

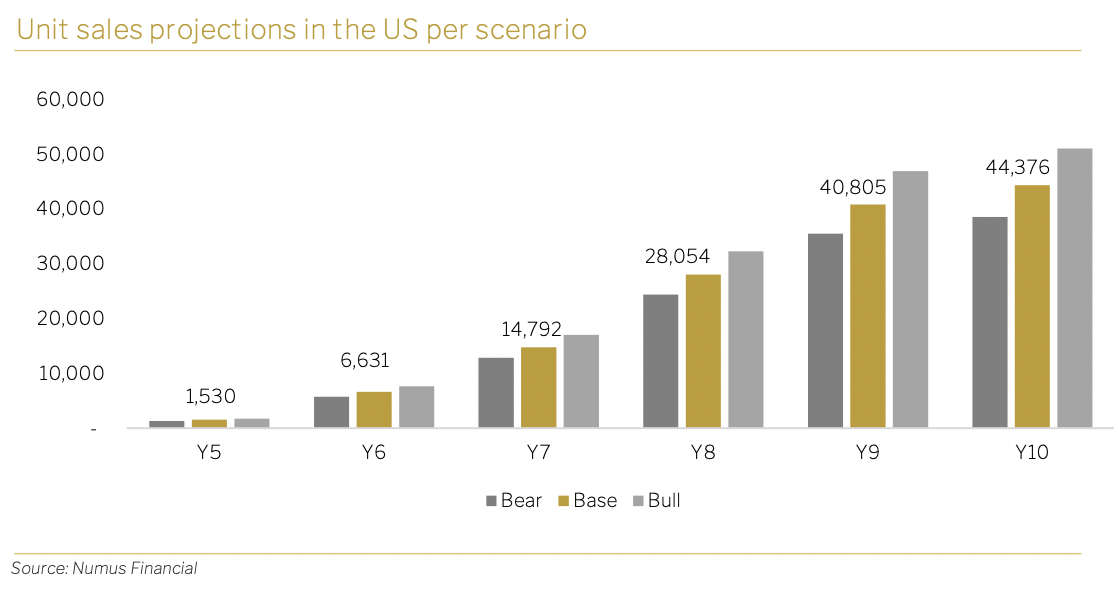

The assumed penetration rates translates to the projected number of units sold, if approval is granted, for Year 5 to 10 in the below graph.

Base case

The base case scenario is the one used in this report to give the outlook on Sona. We show bear and bull cases here for extra context and to allow the reader to understand the different scenarios and drivers for valuation. In the base case, peak penetration rates are 29% in Year 10.

4. Financial Analysis & Outlook

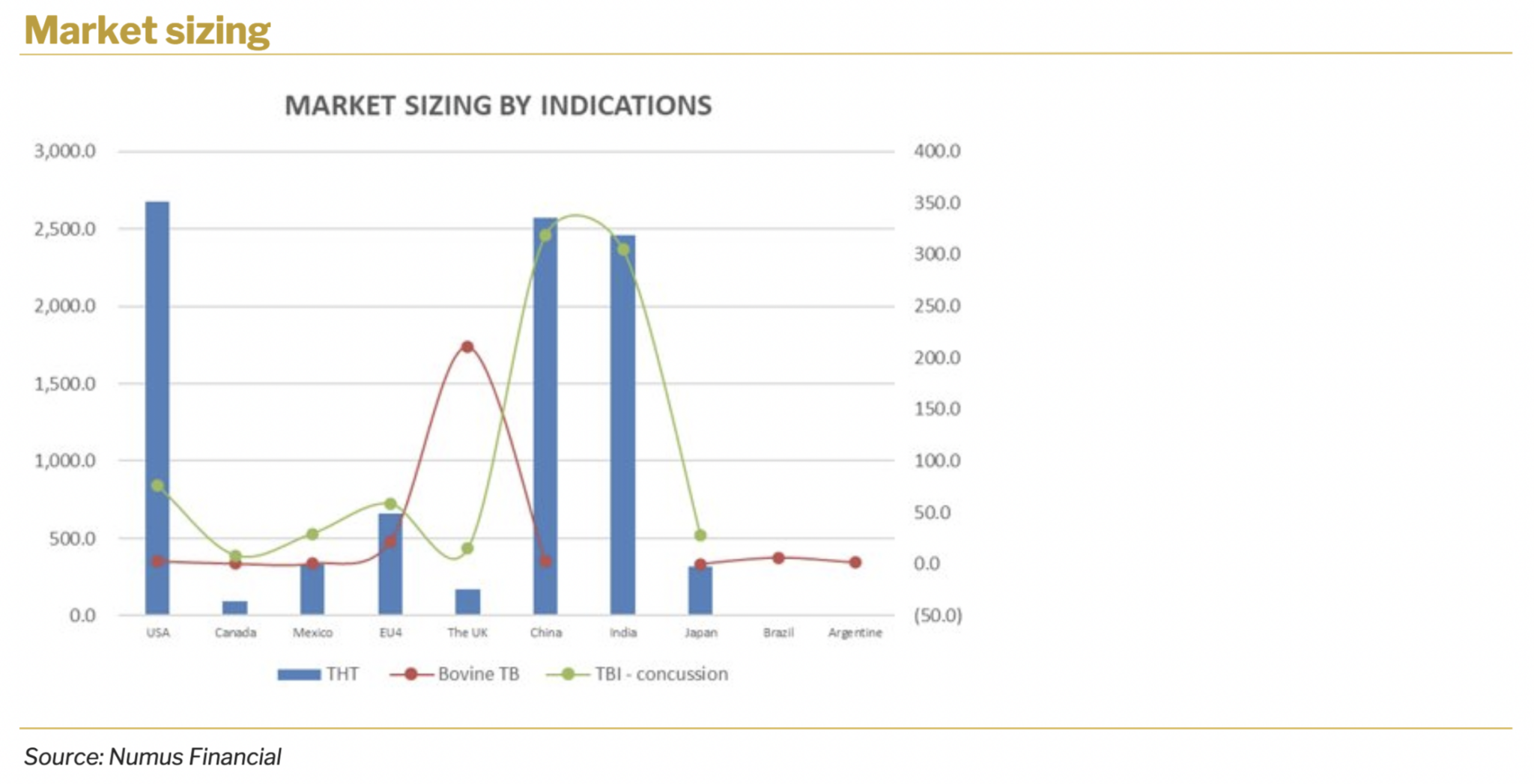

The following passage provides a detailed analysis of the company’s financial outlook both for company totals and for each technology/product line. Projections are made in U$. It is important to note that the largest part of the company’s revenue-generating activities is attributed to the Targeted Hyperthermia™ treatment development. Total Addressable Market (TAM) for targeted treatment is expected to exceed U$2 billion in the US alone.

4.1. TARGETED HYPERTHERMIA™ THERAPY (THT)

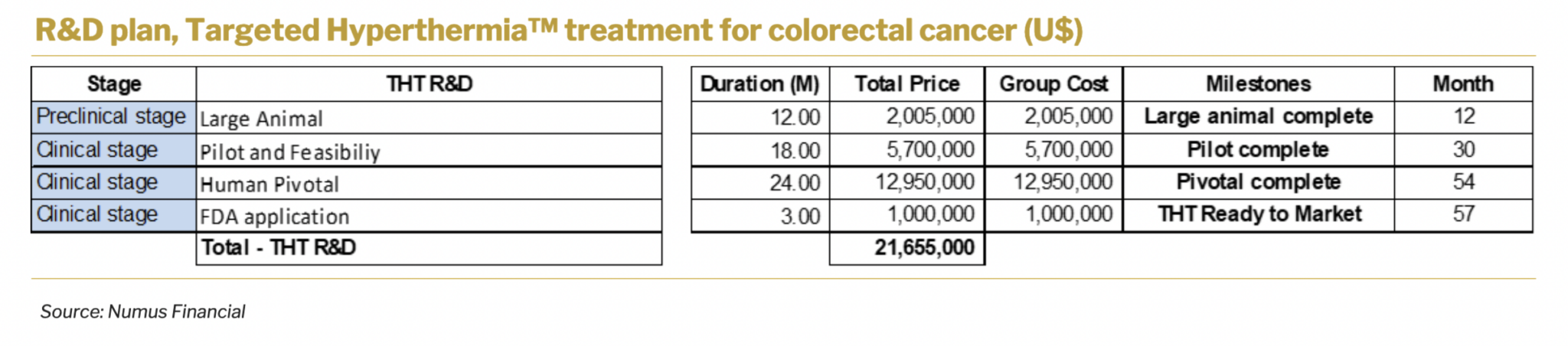

Targeted Hyperthermia™ treatment for colorectal cancer is a primary candidate in Sona’s pipeline. The company plans to develop the product internally and doesn’t foresee licensing out of the technology as a primary route of development. At the current stage of development, the company plans to run large animal studies that will take roughly 12 months and reach around U$2 million. In total, R&D costs are forecasted to reach U$22 million and take roughly 57 months. This R&D plan is solely for the development of therapy for colorectal cancer treatment.

4.2. DIAGNOSTICS

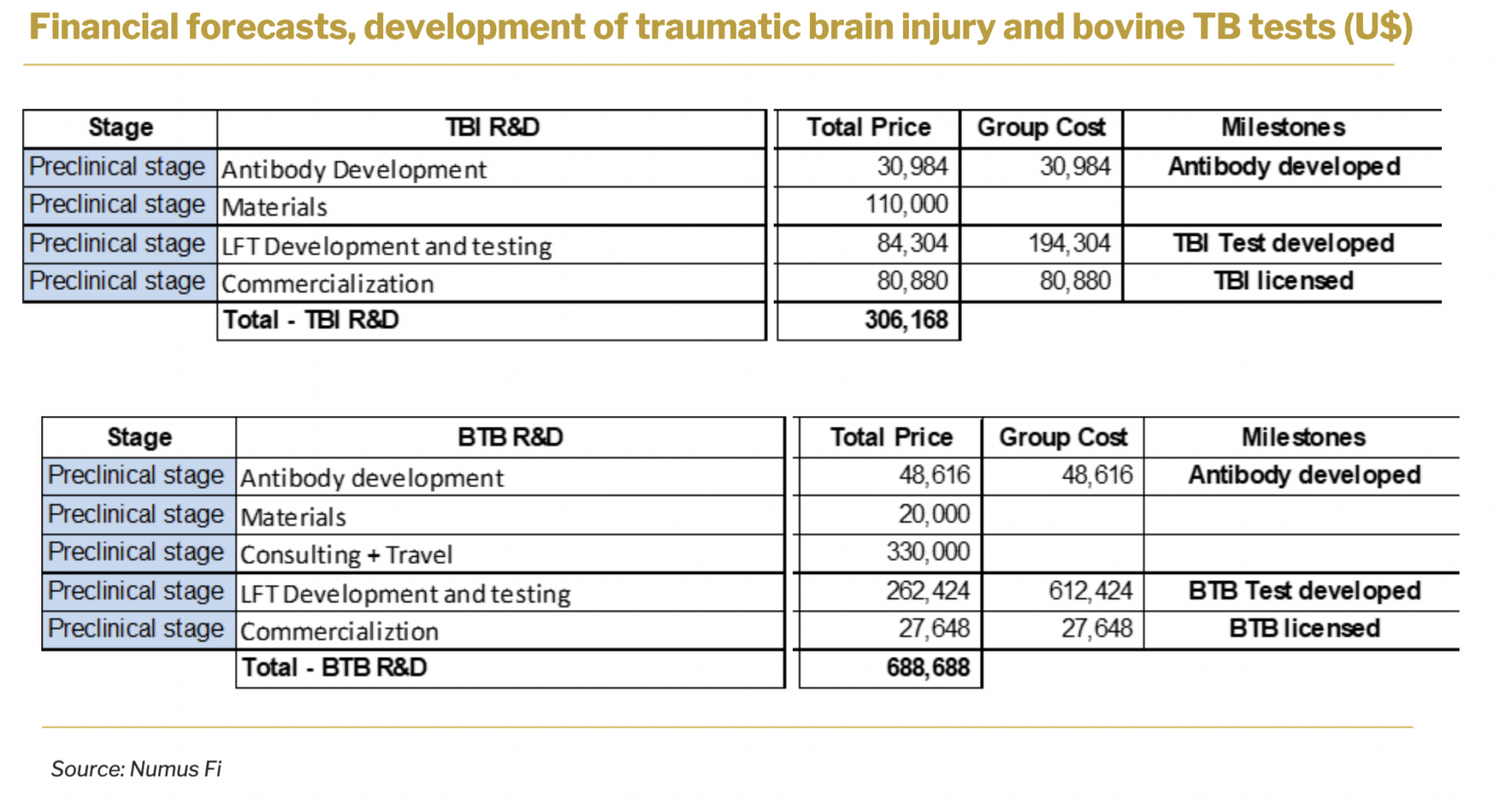

Sona has outlined a strategic approach to the diagnostics technology by planning to license it out, which is expected to generate substantial revenue through licensing agreements. For bovine TB diagnosis, the development phase is estimated to have a total R&D investment of approximately U$690,000.

The total R&D investment is expected to be about U$306,000 for concussion diagnosis.

These milestones and timelines are Numus’ best estimates for the process. Ongoing research and engagement with the regulator may change the timing or type of clinical work that is required for approval. These procedural matters are constantly being updated.

Sona has outlined a strategic approach to the diagnostics technology by planning to license it out, which is expected to generate substantial revenue through licensing agreements.

The total R&D investment is expected to be about USD306,000 for concussion diagnosis.

For bovine TB diagnosis, the development phase is estimated to have a total R&D investment of approximately USD690,000.

5. Intellectual Property

5.1. IP

The following table summarizes Sona’s existing IP applications and their most recent statuses. All applications have been generated from US201762581669P and focus on the claim in research of metal nanoparticles and methods of their making.

Application number | Geography/regulator | Assignee | Status |

EP3703886A4 | European Patent Office | Sona Nanotech Inc | Pending |

KR102513016B1 | South Korea | Sona Nanotech Inc | Granted on 2023-03-22 |

US20200390908A1 | United States | Sona Nanotech Inc | Pending |

CA3079759A1 | Canada | Sona Nanotech Inc | Pending |

JP2021501832A | Japan | Sona Nanotech Inc | Pending |

CN111511484A | China | Sona Nanotech Inc | Pending |

WO2019084661A1 | WIPO (PCT) | Sona Nanotech Inc | Pending |

US-10064940-B2 | United States | Siva Therapeutics | Granted on 2018-09-04 |

In May 2023, Sona announced the first territorial patent grant for its proprietary, toxin-free gold nanorod manufacturing process with registration in South Korea. Patent applications for other major markets and global regulators are still pending. Approval of patent application in South Korea is a significant positive signal showcasing company’s probability of success in achieving IP protection in key markets.

5.2. LICENSING AGREEMENT

The company has previously entered into a licensing agreement with the Colorado School of Mines, dated January 31, 2013. This license awarded full research and commercialization rights to the US patent 12/197044 and related foreign filings. The core claim in the patent is gold nanorod conjugation technology and subsequent use. This license agreement has served as an important pedestal for Sona’s IP- protected R&D activities.

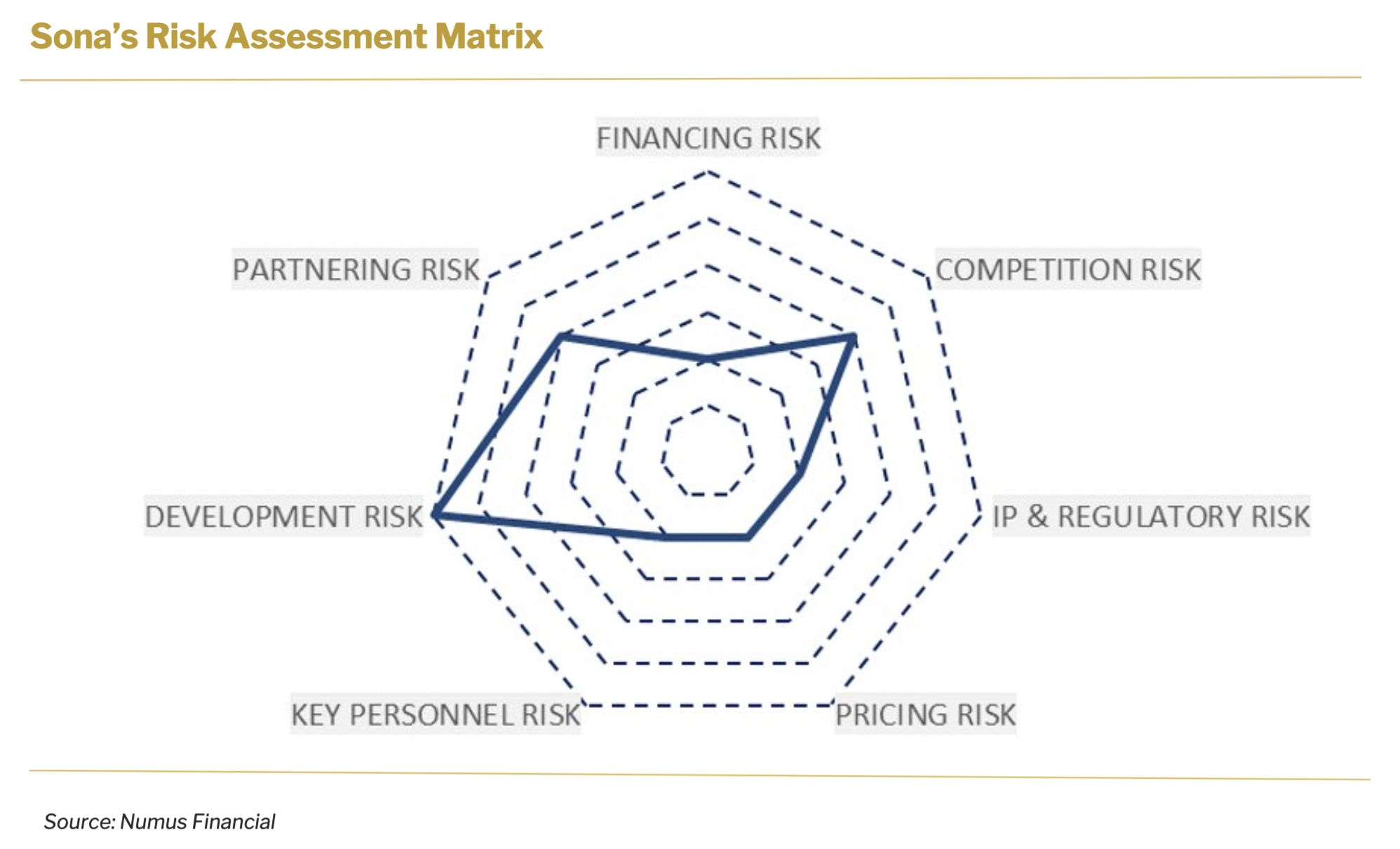

6. Risk Assessment

FINANCING RISK

Throughout its history, the company has been successful in raising capital and it has been witnessed in multiple fundraising rounds. By acquiring Siva Therapeutics, Sona has achieved significant technology synergies in particular in the development of THT therapy, therefore we believe this will serve as an additional point of interest for Sona and will further aid with fundraising efforts. Furthermore, the approval of the patent in South Korea and the positive assessment results from the U.S. National Cancer Institute’s Nanotechnology Characterization Laboratory (NCL) will increase investor interest in the company.

PARTNERING RISK

Partnering risk is significantly low considering Sona’s limited dependence on third parties. Significant internal capabilities allow the company to lead key business functions such as R&D and business development without significant barriers. The company plans to license out two of its main diagnostics technologies, bovine TB and TBI concussion tests.

KEY PERSONNEL RISK

Besides technology synergies, another significant achievement of the merger was the strengthening of the company’s science team. Additionally, long-term commitments from senior management and company performance-aligned compensations, expressed in options and warrants, are the basis for the company’s ability to retain its key personnel throughout the critical development period.

DEVELOPMENT RISK

Development risk is moderately characteristic of the industry benchmarks. Long- term development pathway for THT therapy creates moderate risk, nevertheless, the absence of CTAB in Sona GNRs serves as an important factor in successful in- human treatment development. This assumption was recently confirmed by the assessment of Sona’s proprietary gold nanorod nanoparticles from the U.S. National Cancer Institute’s Nanotechnology Characterization Laboratory (NCL). In addition to running similar assessments to those that have been previously announced for contamination and endotoxin levels, this assessment included an analysis of the surfactant residue present following the chemical reaction necessary for the manufacture of Sona’s proprietary GNRs.

The assessment shows that the continued improvements in Sona’s manufacturing process for GNRs have resulted in a significant reduction in free surfactant levels in nanorod dispersions. As with the NCL’s prior assessments of earlier batches of Sona’s GNRs, this new assessment did not detect any endotoxins or microbial contamination.

PRICING RISK

The risk in the company’s ability to direct its pricing strategy and ensure its sustainability over the long-term period is largely nonexistent. IP protection will allow the company to set commercially appealing prices over long periods. This is particularly substantial in the case of THT therapy as price elasticity in cancer treatment is non-existent.

IP and REGULATORY RISK

We believe IP and regulatory risk for Sona is in line with industry benchmarks for companies that have similar developmental pathways. Since 2021, the company has entered into a consulting agreement with an internationally recognized full service CRO and regulator consultancy. It has a scope of receiving assistance in regulatory pathway development for hyperthermia using nanoparticle-based infusion technology for tumors and neoplastic tissues. The consultant will also draft and submit premarket submissions for discreet components of a system, including a full system for regulatory approvals, and will also provide onsite assistance for clinical trial monitoring.

COMPETITION RISK

Competition risk is also moderate and in line with industry benchmarks. The company’s main competition will arise less from the THT treatment alternatives, but more from the interventional oncology space.

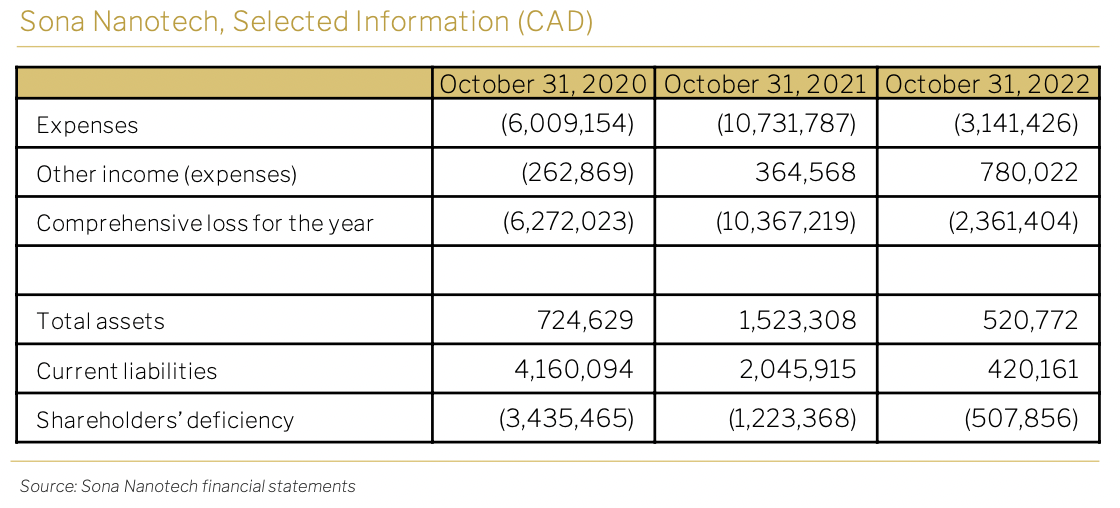

7. Appendix: financial statements

FINANCES

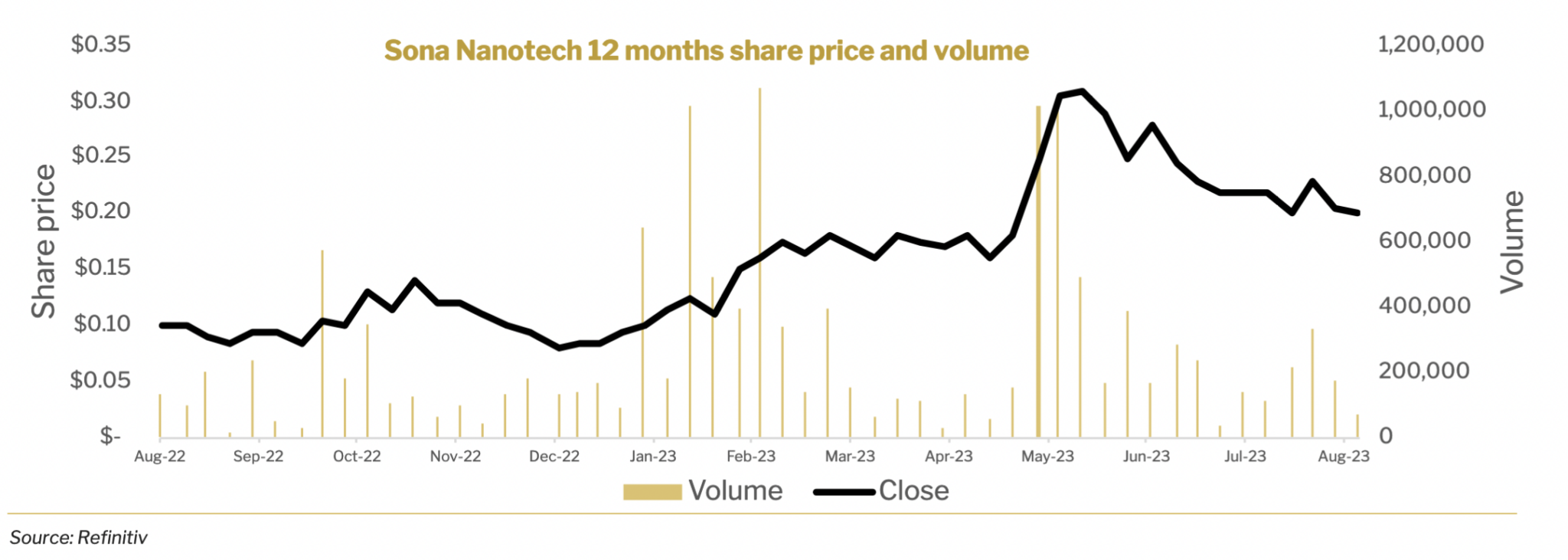

In the fiscal year 2022 (YE 31/10/22), Sona reported a loss of CAD2.4 million, with the majority of it attributed to share-based compensation expenses totaling CAD1.5 million. The cash balance for the period stood at CAD155,000, and the estimated adjusted cash burn for the same period amounted to CAD860,000.

Moving to the first quarter of 2023 (QE 31/01/23), Sona reported a net loss of – CAD0.4 million and a cash balance of CAD96,000. During the first half of 2023, the company successfully completed the acquisition of Siva Therapeutics, which was financed through equity exchange and equity placement transactions.

Considering the current product pipeline, it is projected that Sona will require financing of CAD30 million over the next five years.

8. Appendix: Select Management and Directors

David Regan, MBA

CEO

Business and commercial operations oversight

Strategy consultant and corporate director

15 years public company experience in strategy, IR and corporate development

MBA from INSEAD and BBA (Hons) from St. Francis Xavier University

Len Pagliaro, PhD

CSO

• Prof. of Bioengineering & Laboratory Medicine at University of Washington

• 24yrs exp with biotechnology products, services, & technology licensing

• Developed commercialization at BioImage from concept to a $26M P&L in 4 yrs, leading to acquisition & integration by ThermoFisherScientific

• As CEO of Dynamic Light, Inc. led the spinout of an academic team from concept to first revenues in under 3 years

Darren Rowles

Head of Diagnostics

• 17 years’ experience with nanoparticle diagnostics

• Grew nanoparticle sales from $200K to $5.5M with ~$4M profit

• Advisory board member to Gold Conference and multiple university collaboration projects

• MBA from Bath University and BSc in Biomedical Science and Toxicology from UWIC

Kulbir Singh, PhD

Co-Founder & Head of GNR R&D

• Responsible for GNR development

• Named author on 35 research papers and 2 patents

• PhD in chemistry from Guru Nanak Dev University

• Co-founder of a science-based, consumer product company

Robert Randall, CPA

Chief Financial Officer

• Extensive public company experience as CFO of Torrent Capital, Antler Gold and eXeBlock Technology

• B.Comm. from St. Mary’s University with CA designation in 1987 with Coopers and Lybrand Chartered Accountants

Disclaimer and Disclosure

This report is provided to you for informational purposes only. The results stated herein are Numus Financial’s own conclusions. Investors should consider this report as only a single factor in making their investment decision.

Numus Financial Inc and its subsidiary, Numus Capital Corp, have and may from time-to-time own shares in the company mentioned in this report.

Nothing contained in this report is, or should be, relied upon as a promise or representation as to the future performance. The estimated financial information contained in this report, if any, is based on certain assumptions and the analysis of information available at the time that this information was prepared. There is no representation, warranty or other assurance that any projections contained in this report will be realized.

This report is not intended to provide personal investment advice. Investors should seek professional advice regarding the suitability of any investments or strategies discussed in this report. Opinions, estimates and projections are those of Numus Financial Inc and are subject to change without notice.

Individuals involved in the production of research materials are employed permanently or on a freelance basis by Numus Financial Inc. The author has qualifications that qualify them to produce the report. The author will provide continuing coverage at the request of Numus Financial Inc.

This report is not and is not to be construed as (i) an offer to sell or a solicitation to buy securities or (ii) an offer to transact business in any jurisdiction or (iii) investment advice to any party. Products and services described herein are only available where they can be lawfully provided.

RelationshipBetweenSonaNanotechInc. andNumusFinancialInc.

Numus Financial, Inc. (“Numus”) is a venture capital firm based in Canada. Various, publicly disclosed relationships exist between Sona, Numus, and various shareholders, officers and directors of each company. Wade Dawe is a principal of Numus Financial and an insider of Sona, and Jim Megann is a principal of Numus Financial and a director of Sona.

Numus has also arranged various loans for Sona, Numus Capital has acted as an agent to Sona’s brokered private placement financings, and Numus is currently engaged by Sona through a Services Agreement.